Key Takeaways

- State Responses to Conformity

- Ohio cases provide guidance on sourcing temporarily stored goods

- Rhode Island introduces bill for annual Amnesty Program

-

States Move to Shut the “Montana Loophole”

Welcome to this edition of our roundup of state tax developments. The State Tax News and Views is published biweekly. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance and incentive needs.

From Rolling to Fixed: Understanding States’ Shifting Approaches to Conformity

Melissa Menter, Eide Bailly

A Closer Look at Legislative Approaches to Evolving Federal Tax Rules

State Responses to Conformity Issues Under OBBBA - Bruce P. Ely and James E. Long Jr., Tax Notes ($):

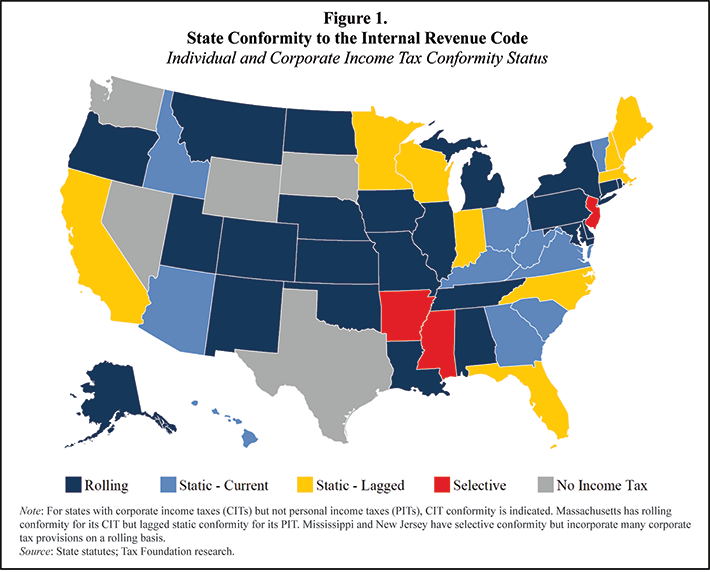

Every state that levies a net income tax has been studying the impact of the OBBBA on their income tax codes and revenues for months now. Several have publicly issued reports on that impact, and a number of state legislatures — especially those with income tax codes that automatically incorporated many, if not most, OBBBA tax changes — have convened special sessions to determine how to respond (see map showing the different methods states use to conform to the IRC).

ARIZONA

Arizona Governor Vetoes Republicans' Tax Conformity Bill - Paul Jones, Tax Notes ($):

The GOP-backed bill — S.B. 1106 — broadly adopted provisions contained in the OBBBA (P.L. 119-21), including business tax cuts, the higher standard deduction, and most of the temporary individual deductions, including those for tips and overtime pay. After the Senate passed S.B. 1106 on a 17–12 vote and the House approved it 31 to 27 on January 15, Hobbs rejected the measure the next day.

Hobbs has called for conforming to the OBBBA's higher standard deduction and tax breaks for tips and overtime pay and for senior citizens, calling her plan the Middle Class Tax Cuts Package. She opposed the GOP’s push to more broadly conform to the federal changes and criticized them for not including the OBBBA’s new tax deduction for seniors over 65 years.

Ariz. Panel OKs Bill To Codify Tax Form Conformity - Sanjay Talwani, Law360 ($):

Under S.B. 1180, recommended for passage unanimously by the Senate Finance Committee, the Arizona Department of Revenue must produce materials that assume the state will enact legislation to conform with federal law on federal adjusted gross income. If the state does not conform with the federal changes, the department would supplement the materials, according to the bill.

INDIANA

Indiana Tax Committee Advances OBBBA Conformity Bill - Emily Hollingsworth, Tax Notes ($):

S.B. 243 was approved by the Senate Committee on Tax and Fiscal Policy on an 11-1 vote on January 20. The bill would conform to some provisions of the One Big Beautiful Bill Act (P.L. 119-21), including the temporary income tax deductions on tipped income and overtime pay, for tax year 2026.

The bill would also require taxpayers that claim the OBBBA's special depreciation allowance for qualified production property under IRC section 168(n) to add back the amount deducted when calculating adjusted gross income for state tax purposes.

MASSACHUSETTS

Massachusetts Governor's Bill Proposes Phased-In OBBBA Conformity - Emily Hollingsworth, Tax Notes ($):

H. 4975, filed January 15, would phase in conformity with five business deduction provisions of the OBBBA (P.L. 119-21) over a two-year period. The bill was referred to the Joint Committee on Revenue January 22.

[...]

Currently, Massachusetts automatically conforms to the five OBBBA provisions.

SOUTH DAKOTA

South Dakota Working to Update IRC Conformity to January 1, 2026 - Melissa Menter, Eide Bailly:

South Dakota's senate unanimously passed S.B. 19 to update the state's conformity to the United States Internal Revenue Code (IRC) as amended and in effect as of January 1, 2026. The bill now goes to the House Taxation Committee for consideration. You may ask, "Why does conformity matter to South Dakota, a state with no individual or corporate income tax?" While it's true that South Dakota does not impose an income tax on individuals or corporations, states often conform to federal tax law for reasons beyond calculating taxable income. In South Dakota, the bank franchise tax, retail sales and service tax refunds, and property tax and nonprofit provisions rely on the IRC definition of net income. Because these areas tie directly to federal concepts, updating the state's conformity date ensures consistency, clarity, and administrative efficiency across multiple state and tax regulatory systems.

Currently, South Dakota conforms to the Internal Revenue Code as of January 1, 2025. This bill would update conformity to include changes enacted in July under the One Big Beautiful Bill Act.

WASHINGTON D.C.

BGOV Bill Analysis: H. J. Res. 142, Block DC Tax Code Decoupling - Brandon Lee, Bloomberg Tax ($):

The DC Council approved a pair of bills at the end of 2025 after DC’s chief financial officer found that tax provisions in Republicans’ budget reconciliation package (Public Law 119-21) created a $539.4 million gap in the local budget through fiscal 2029 due to a drop in estimated tax revenue.

States Target Loopholes, Ohio Courts Clarify Sourcing Rules and Lawmakers Weigh New Amnesty Paths

GEORGIA

Georgia’s Plan to Eliminate Income Taxes Would Burden Businesses - Alla Raykin, Bloomberg Tax ($):

Georgia’s current budget surplus may mask the immediate revenue consequences, but reinstating a personal income tax once eliminated would be politically impossible. Lower revenue would force lawmakers to face tough choices: higher rates for other taxes, entirely new taxes, or broader tax bases for existing tax bases. The uncertainty created by the prospect of future revenue shortfalls would undermine Georgia’s reputation as a business-friendly state.

ILLINOIS

Illinois Tax Issues & Updates 2026: Questions Answered - Rheanon Rabideau, University of Illinois Tax School:

The University of Illinois Tax School held its Illinois Tax Issues & Updates webinar on January 22, 2026. During the session, participants submitted a wide range of Illinois-specific tax questions.

To make those answers easier to reference during filing season, the instructor has compiled responses to the most common and timely questions below. Topics include Illinois Department of Revenue procedures, available credits, pass-through entity capital gain apportionment, and recent apportionment law changes.

MONTANA

More States Cracking Down on Tax Losses From Montana LLCs- Michael J. Bologna, Bloomberg Tax ($):

Lawmakers in Indiana and Missouri are advancing legislation cracking down on residents abusing a tax sheltering strategy by which motorists set up Montana limited liability companies to purchase cars, boats, recreational vehicles, and aircraft. Montana has no statewide sales tax and very low vehicle registration and renewal fees, causing thousands of non-Montana residents to plate their vehicles in the Big Sky state each year.

OHIO

Ohio Justices' Tax Rulings Offer Blueprint For Sourcing Proof - Michael J. Bologna, Law 360 ($):

The state high court's decisions denying commercial activity tax refund claims from Jones Apparel Group/Nine West Holdings and VVF Intervest LLC included silver linings for taxpayers who argue that their receipts should be sourced to locations where the merchandise was ultimately sold, according to tax practitioners.

RHODE ISLAND

RI Bill Would Establish Yearly Tax Amnesty Period - Michael Nunes, Law 360 ($):

Introduced on Thursday, H.B. 7398 would require the state tax administrator to create a one-week tax amnesty period every fiscal year. If enacted, the legislation would take effect immediately.

Rhode Island Finds Online Subscription Sales Taxable as Computer Software - Tax Notes ($):

The Rhode Island Department of Revenue, Division of Taxation, found that they had properly assessed the taxes owed by a foreign company with regard to their sales of vendor-hosted online subscriptions, as in the initial assessment they had been determined to be taxable as prewritten computer software.

WEST VIRGINIA

West Virginia Issues Guidance on Nonbusiness Income - Colette Sutton, Eide Bailly:

West Virginia’s TSD‑392 breaks down how the state handles nonbusiness income for corporations, offering a clearer picture for multistate taxpayers navigating allocation rules. Because West Virginia starts with federal taxable income, corporations must adjust that figure for state‑specific additions and subtractions, then separate business income—apportioned through a property, payroll, and double‑weighted sales formula—from nonbusiness income, which gets allocated directly to where it arises. The guidance highlights common categories of nonbusiness income, such as rents, royalties, interest, dividends, capital gains, and intangible income, emphasizing that these items qualify only when they aren’t connected to the company’s normal business operations. For companies operating solely within West Virginia, all net income remains fully taxable in‑state, simplifying the process even when nonbusiness income is involved.

SEASONED WITH SALT

Tax Tips, Tricks and Opportunities

Post-OBBBA State Considerations for Foreign Source Income - Jennifer Barajas, Eide Bailly

The One Big Beautiful Bill Act (OBBBA) significantly modified the Tax Cuts and Jobs Act (TCJA) approach to taxing foreign source income. Effective for tax years beginning after December 31, 2025, OBBBA amended the federal Internal Revenue Code (IRC) sections 951A and 250, including a shift from Global Intangible Low-Taxed Income (GILTI) to Net CFC Tested Income (NCTI) and removal of the Qualified Business Asset Investment (QBAI) deduction. Many taxpayers are expected to see higher federal and state taxable income as a result of the OBBA changes. Additionally, since many states do not offer foreign tax credits comparable to the federal foreign tax credit, there is a greater chance of double taxation of foreign earnings. Post OBBBA, taxpayers should closely monitor each state's conformity position, rolling, static or selective, to determine if the state follows NCTI, GILTI or adopts a hybrid approach. States with rolling conformity to the IRC will include a broader foreign income base under the NCTI rules, increasing the state's taxable income. States with static or fixed conformity to the IRC as of a date before OBBBA will continue to use GILTI, and states that update conformity or selectively adopt NCTI need to provide guidance to taxpayers related to the state differences created by nonconformity, including rules for state apportionment. Because state apportionment rules were not designed with NCTI in mind, there is uncertainty in how to account for foreign sales, property or payroll when NCTI is included in the state's tax base. Keeping track of the varying rules between states creates an administrative headache for taxpayers who may need to calculate both GILTI and NCTI and adjust state apportionment methods to comply with varying state requirements. Tax professionals may need to maintain GILTI and NCTI workpapers for several years while waiting on states to fully address conformity and apportionment issues.

Make a habit of sustained success.